Juniper Research predicts that the value of global open banking payment transactions will exceed $330 billion by 2027, up from $57 billion in 2023. And no wonder, as now, people can collect personal financial analytics, get a loan in a few minutes, or buy cryptocurrency in a few clicks. All this is possible thanks to open banking. Moreover, according to Finastra, 7 out of 10 banks say open banking can increase their customer reach. And this is a positive sign for technology.

This article discusses how open banking works, open banking regulations, and open banking challenges.

Key points

What is Open Banking?

Open banking provides access to banking data to third parties, with the consent and authorization of all parties, primarily users. How does it work in practice?

For example, a person has been using the services of a large bank for many years. He or she owns several cards, makes regular deposits, and perhaps even makes investments. The bank is a fairly reliable but conservative player on the market. The person wants to connect smart analytics to his data and get valuable insights about personal budgets and financial habits. For this purpose, the bank, through an open API, must grant access to a third-party company that specializes in such smart analytics. The person agrees to share data and gets a detailed expenses, income, capital, and expected revenue summary.

Another use case is aggregating data from different bank accounts in one application or messenger. The system automatically gets data and analyzes it in real-time.

How does open banking work?

Open banking-based services can perform any function: analyze credit history, collect statistics, assess the client’s trustworthiness according to parameters, etc. But all exclusively with the user’s consent. Moreover, any data exchange takes place on the client’s initiative.

For example, a customer buys a new smartphone and wants to apply for an installment plan directly from an online electronics store. The payment service connects to the bank via an open API and collects information about the customer: transaction statistics, proof of stable income, and availability of assets. It determines the degree of risk. The whole process can take a few seconds, and the user makes an installment in 2 clicks.

This model is called Buy Now, Pay Later, and the market for such services is already estimated at $100 billion. For example, Amazon cooperates with Affirm, which offers to purchase even relatively inexpensive goods in installments. The boom of BNPL happened just due to the development of open banking as barriers to data exchange decreased, and the time for processing transactions was reduced.

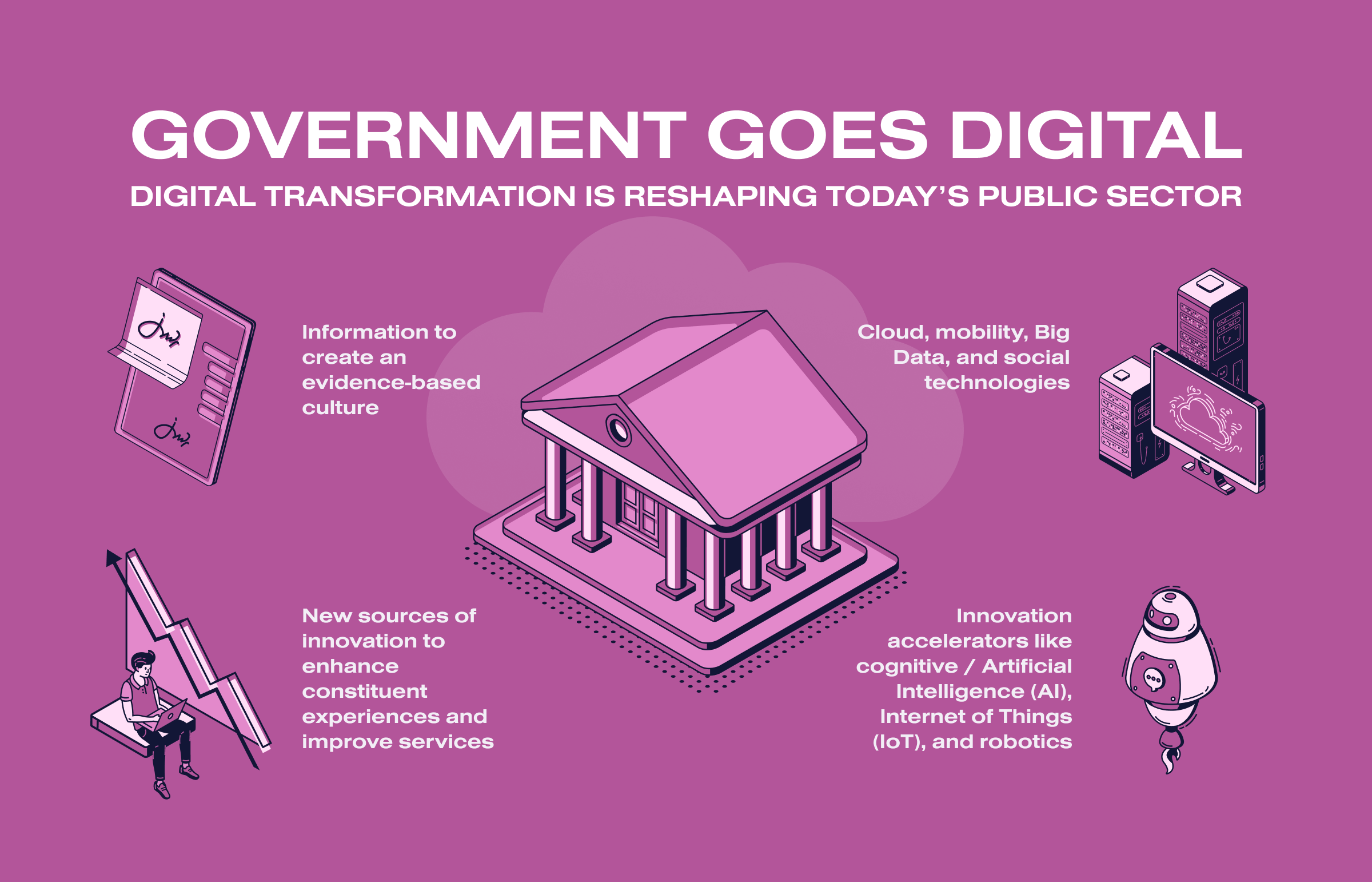

Open banking has clear advantages. For example, lowering the threshold of access to financial services. Previously, a bank would deny a company a loan because it could not collect sufficient data. Now, by aggregating information from different sources, it will be decided in a short period. At SoloWay Techh, we consider open banking a part of digital transformation in the banking industry.

How do startups use data provided by open banking APIs?

Open banking APIs are like eCommerce APIs. They simplify work for startups and help them connect new services faster. For example, a company does not need to create its own credit or payment module or use the services of intermediaries, such as credit bureaus. Using open data, a startup can enter the market at minimal cost.

Startups in crypto and gaming actively use open banking. For example, Blockchain.com allows people to deposit money to their cryptocurrency wallet directly from their bank account without entering unnecessary data. Another case is the collaboration of Klarna (payment service) and Safello (brokerage platform for crypto traders): users can buy cryptocurrencies in a few clicks.

McKinsey analysts believe that open banking will benefit small players. Free access to financial information will increase GDP by 1.5% in Europe, Britain, and the United States. However, small companies and startups are not maximizing the opportunities. Access to open APIs is still expensive, as it is often necessary to contact intermediaries and providers.

In addition, it is not easy to get data. For example, in Europe, a company needs a license from the Financial Conduct Authority (FCA) or another regulator to get on the register of approved services and access personal data.

Open banking regulations

Here’s a general picture of how open banking is regulated in different countries:

- European Union (EU). PSD2 (Payment Services Directive 2) supports the proliferation of open APIs. Regulators have recognized that open banking creates a foundation for healthy competition and prevents banks from monopolizing the market. In doing so, they introduced new regulations, for example, stricter customer authentication rules.

- United States of America (USA). In the USA, open banking regulation is more fragmented and depends on different laws and agencies. For example, the Dodd-Frank Act sets standards for financial institutions on data security and privacy. Supervisory agencies such as the OCC (Office of the Comptroller of the Currency) and CFPB (Consumer Financial Protection Bureau) also influence regulation.

- United Kingdom. The UK has the General Data Protection Regulation (GDPR), which regulates the processing of personal data in the banking sector. The Open Banking Initiative in the UK obliges banks to allow third-party providers access to data according to set security standards.

- China. In China, open banking regulation is overseen by the China National Development and Reform Commission (NDRC) and the Beijing National Banking Association. China is actively developing open banking and digital financial services but also strictly controls people`s security.

- Ukraine. In Ukraine, several laws and regulations regulate open banking and fintech. They include the Law on Payment Systems and Transfers, the activities of the National Bank of Ukraine, the Law on Financial Services and State Regulation of Financial Services Markets, and laws on cybersecurity and personal data protection. Supervisory authorities, such as the National Commission, responsible for state regulation of financial services markets, also play an important role in controlling and supervising the country’s financial infrastructure.

Of course, information was exchanged before open banking. Companies used screen scraping, a more aggressive method of collecting information. The client did not just share part of the data but actually let a third-party company into his or her account. That is, third parties could log in on behalf of the user, and the bank could not influence this in any way. Now, this practice is being abandoned because of the risks. But Open APIs are not yet available everywhere, so sometimes clients resort to this less secure method.

Open banking challenges

One of the main challenges of open banking is security. Neither a bank nor a fintech startup is 100% safe from hacking and data leaks today.

Open APIs, on the one hand, increase the number of interaction points with the service. On the other hand, they are more secure than the same web scraping, in which an intermediary gains access to the user’s login and password. And the new regulatory norms focus on security. For this purpose, for example, banks are obliged to introduce additional levels of authentication. In addition, banking institutions monitor all transactions and quickly track fraudulent activities since compliance regulations require this.

APIs in the financial sector are strictly regulated, so a dubious startup will not get access to an open interface. Of course, complying with all regulatory norms requires additional resources. Not all companies have them.

Another challenge that bank representatives often mention is the directive approach to implementing open banking. Regulators give instructions, and organizations must adjust quickly, often requiring large investments, including additional security systems.

Some other challenges may manifest themselves in the future. For example, competing companies will learn to dump and offer customers more favorable rates but risk failing to meet obligations due to the influx of users. In addition, providers will be able to build more detailed profiles of users and offer them more targeted advertising. This makes life easier on the one hand but violates privacy on the other.

In any case, no technology in itself can be harmful or useful. It all depends on the scenarios of its application.

5 open banking examples

Here are five specific companies that have implemented open banking initiatives and services:

- Plaid. It is a well-known fintech company that offers a platform for connecting financial applications to users’ bank accounts. They provide APIs that allow developers to access bank account information, verify account balances, and initiate payments. Various financial apps, including budgeting tools and investment platforms, widely use Plaid’s services.

- Yodlee (a part of Envestnet | Yodlee). It is a leading data aggregation and analytics platform. It offers Account Information Services (AIS) and APIs, enabling financial institutions and developers to access and utilize financial data securely. Yodlee’s services are used by banks, wealth management firms, and fintech companies to offer personalized financial solutions.

- Adyen. It is a payment system that facilitates Payment Initiation Services (PIS). Adyen’s platform allows businesses to accept payments directly from customers’ bank accounts. They support various payment methods, including bank transfers, to offer a seamless and secure payment experience.

- Revolut. It is a neobank that utilizes open banking principles to provide various financial services. Customers can link their external bank accounts to their Revolut app, allowing them to view all their financial information in one place, make cross-border payments, and manage their finances more effectively.

- Mint (by Intuit). It is a popular personal finance management app owned by Intuit. Mint uses open banking by connecting to users’ bank accounts, credit cards, and other financial accounts to provide insights into their financial health. It offers budgeting, expense tracking, and investment tracking features, making it easier for users to manage their money.

These companies exemplify the application of open banking principles and APIs to offer innovative financial services, improve financial transparency, and empower consumers with better control over their finances.

We also recommend you read our article “Mobile Banking App Development: Complete Guide”

How can SoloWay Tech help you with the integration of open banking APIs?

SoloWay Tech is a renowned software development company from Ukraine with experience in over 10 industries. We worked with projects in the following industries: eCommerce, manufacturing, eLearning, financing & banking, retail, logistics, and transportation. We have:

- API integration expertise. We have a team of developers and experts with experience in integrating open banking APIs. They can help you connect your systems and applications with various banks and financial institutions’ APIs.

- Compliance and security knowledge. Open banking involves sensitive financial data, and compliance with regulations (such as PSD2 in Europe) and robust security measures are crucial. SoloWay Tech can help ensure your integration meets security and compliance requirements.

- Custom solutions development expertise. We can work with you to develop custom solutions tailored to your specific business needs. This involves building apps, portals, or services that utilize open banking data to enhance your offerings.

- Maintenance and support expertise. Ongoing maintenance and support are essential for the reliable operation of open banking integrations. SoloWay Tech can offer services to ensure your integrations remain up-to-date and function smoothly.

- Scaling expertise. As your business grows, your open banking needs evolve. We can help you scale your integrations to accommodate increased data volume and user demand.

SoloWay Tech can scale quickly as we have a large pool of experienced developers from different domains. Our organized processes will allow us to start working on the project almost immediately. Feel free to contact us to discuss your project!

Conclusion

At first glance, there is nothing revolutionary about open banking. We are already living in the era of Open Data when the mutual exchange of information contributes to analytics. However, access to these opportunities is limited. Small companies cannot afford to invest in tools and data analytics, and large players are still reluctant to integrate newcomers.

That said, the market is gradually transforming. We can buy goods in a few clicks, transfer payments in a single swipe, and receive financial services instantly, whether a credit check or a loan for a startup.

Open banking is often compared to blockchain because it offers a whole new paradigm of transactions. Today, we use certain banks, but tomorrow, we will manage a distributed smart grid of personal finances. For example, store different currencies in accounts at different banks worldwide but conduct transactions between them in a single space in a few seconds. In addition, users and startups will be able to manage finances more efficiently and predict trends, for example, a drop in income or seasonal changes in revenue.

McKinsey estimates that the potential of open banking is only 10% unlocked, and it is too early to conclude. In addition, the crypto market and the decentralization trend of Web 3.0 may greatly impact the industry. Have an idea of your open banking project? Contact us!